Solid seasonal results and promising outlooks have led farmers to continue investing in all aspects of their farming operations, especially innovation and technology; according to a research released today by the Commonwealth Bank.

The Agri Insights Index, which measures famer intentions for the coming year has grown 1.5 points to 8.5 in six months.

The biannual research surveys 1,500 farmers on 14 aspects of farm operation, covering physical aspects (including production scale and land size), financial investment intentions and people aspects (regarding people working in and for the farm business).

In the most recent report, some key areas of potential increased investment include innovation and technology; fixed infrastructure and education and training.

The intention to spend on technology in particular has risen six per cent from last survey to 20 per cent.

Commonwealth Bank executive general manager for regional and agribusiness banking Geoff Wearne says the strong results indicate continuing optimism in the sector.

“With a few good seasons behind them, many farmers are in a position where they’re able to update their on-farm infrastructure and invest in new technology,” he says.

“Appropriately structured finance has a crucial role in supporting farmers to take up the latest innovations and use new technology to maintain a competitive edge.”

The research also shows continuing growth in the financial elements of the Agri Insights Index, driven in part by intentions to increase off-farm investment.

“Off-farm investments provide additional income streams that offer security and help even out the bumps that inevitably come with seasonal businesses,” Wearne says.

“These strategies are especially critical in areas where farm sizes are growing, as farmers in these regions aren’t necessarily diversifying within their core business. Many of these farmers have found through experience that investing outside the farm is a good risk management operation.”

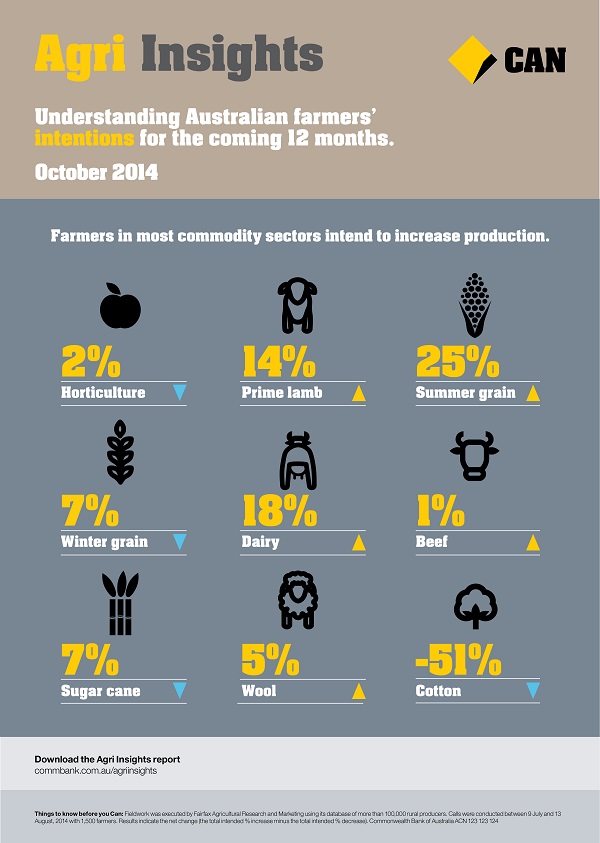

The latest survey shows farmers, especially summer grain, dairy and prime lamb producers, plan to increase their scale of operation in the next 12 months.

Although most commodity sectors look positive, Wearne acknowledged that the cotton sector is still feeling the effects of oversupply and limited water.

“Some cotton growers have had a tough season but it’s important to note that the results only reflect immediate intentions, and we believe the long term outlook for cotton is positive.”

Producers are also increasingly looking to neighbouring countries for more opportunities, with 49 per cent of farmers surveyed saying they already sell to Asian markets.

“The scale of growth in Asia continues and Australia’s reputation for clean, green, safe products is driving a lot of demand,” Wearne says.

“But farmers know that Asian demand alone will not guarantee Australian success in the region. We must identify and act on challenges to market access, and recognise that we’re competing with the rest of the world for Asia’s business.”

Some common issues farmers face with their operations includes competitiveness such as tariffs and labour costs which they urge to be addressed. The survey also found that improving infrastructure that allow farmers to get their product from farm to market is very important.

“Australian agribusiness is moving to a new phase in its relationship with Asia, with lots of new export avenues opening up,” Wearne says.

“From cattle genetics to boxed beef and now even fresh milk, Australian products are highly sought after. The industry needs the right infrastructure, finance and connections to be able to identify and develop opportunities in the region.”

Some regional findings from the report include:

- Queensland optimism is making a strong return, with farmers from the state recording the strongest growth in the Agri Insights Index (up 3.7 per cent to 7)

- New South Wales farmers are particularly focused on investment in fixed infrastructure, with 38 per cent saying they will invest more in this area in the coming 12 months.

- Victorian farmers are much more likely to increase investment in plant and equipment now than when they were last surveyed (19 per cent compared to 11 per cent in May)

- South Australian producers are keen on expanding their operations, with 21 per cent of prime lamb producers expressing expansion intentions.

- Tasmania achieved the highest overall index of all states at 13.6 points. They are the most likely to be spending on fixed infrastructure, with 39 per cent of respondents saying they will do so.

- Western Australian results remain positive, with 31 per cent of WA farmers intending to invest more in fixed infrastructure.

Read more about the latest October 2014 Commonwealth Bank Agri Insights Report.